HOW TO GAIN BACK CONTROL OF YOUR FINANCES

Mar 04, 2022

When thoughts of money give you that sinking feeling in the pit of your stomach, something has to change.

In fact, you shouldn't need to think about money at all. Money is there to serve you. Not the other way round.

Unfortunately, many have experienced unexpected shifts in their finances of late and have been left wondering, ‘How on earth am I going to get through this.’ I too have been there many times in my life. But it IS possible to take back control, and I’m going to show you how to get started.

My six steps to gain back control of your finances:

1. WRITE UP YOUR BUDGET.

This is the very first step in gaining back control of your finances. Unless you know exactly where your money is going, how will you know where to make changes in your spend? Stop burying your head in the sand, it’s time to face the brutal facts.

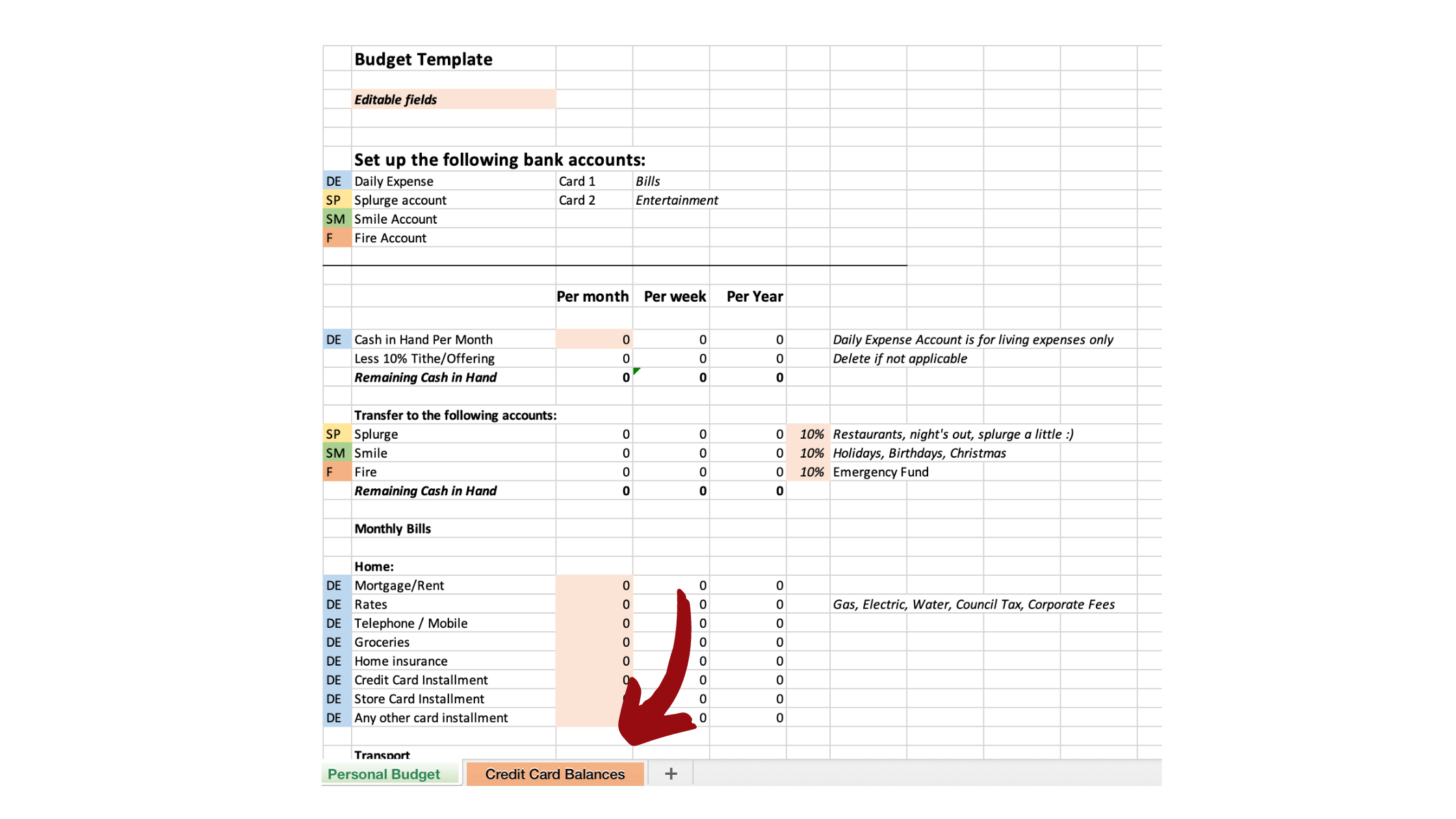

To make it easy for you, I have created a downloadable Personal Budget Template just for you. Simply complete the editable fields and BOOM, you will get a snapshot of your current financial position. I suggest logging into your Internet Banking while you do this exercise. That way you are able to pull facts as well as figures :)

2. DRAW UP A LIST OF CREDIT CARDS OWING.

Within the Personal Budget Template, a separate page has been created called ‘Credit Card Balances’. Use this to draw up a list of all your credit cards owing. It’s important that you have an actual number in your head at the end of this exercise.

3. ARRANGE A BALANCE TRANSFER.

Credit cards are designed to keep you trapped in debt. The only time they work in your favour, is if the balance owing is paid off within the terms set, whereby you are not charged any interest. If you’ve fallen into the trap of paying the minimum monthly installment, you will never be free of your credit card debt.

Start researching ‘0% interest on balance transfer credit cards.’ Then, apply for a card that offers 12 - 24 months interest free on balance transfers. When asked how much you want to transfer, use the number listed in ‘Total Balance Owing’ from item 2 above.

Ideally you want to be able to transfer all of your credit card balances onto this one single interest free credit card. If you cannot obtain the full amount, go with what you’re granted and repeat the exercise until all your debt is paid in full.

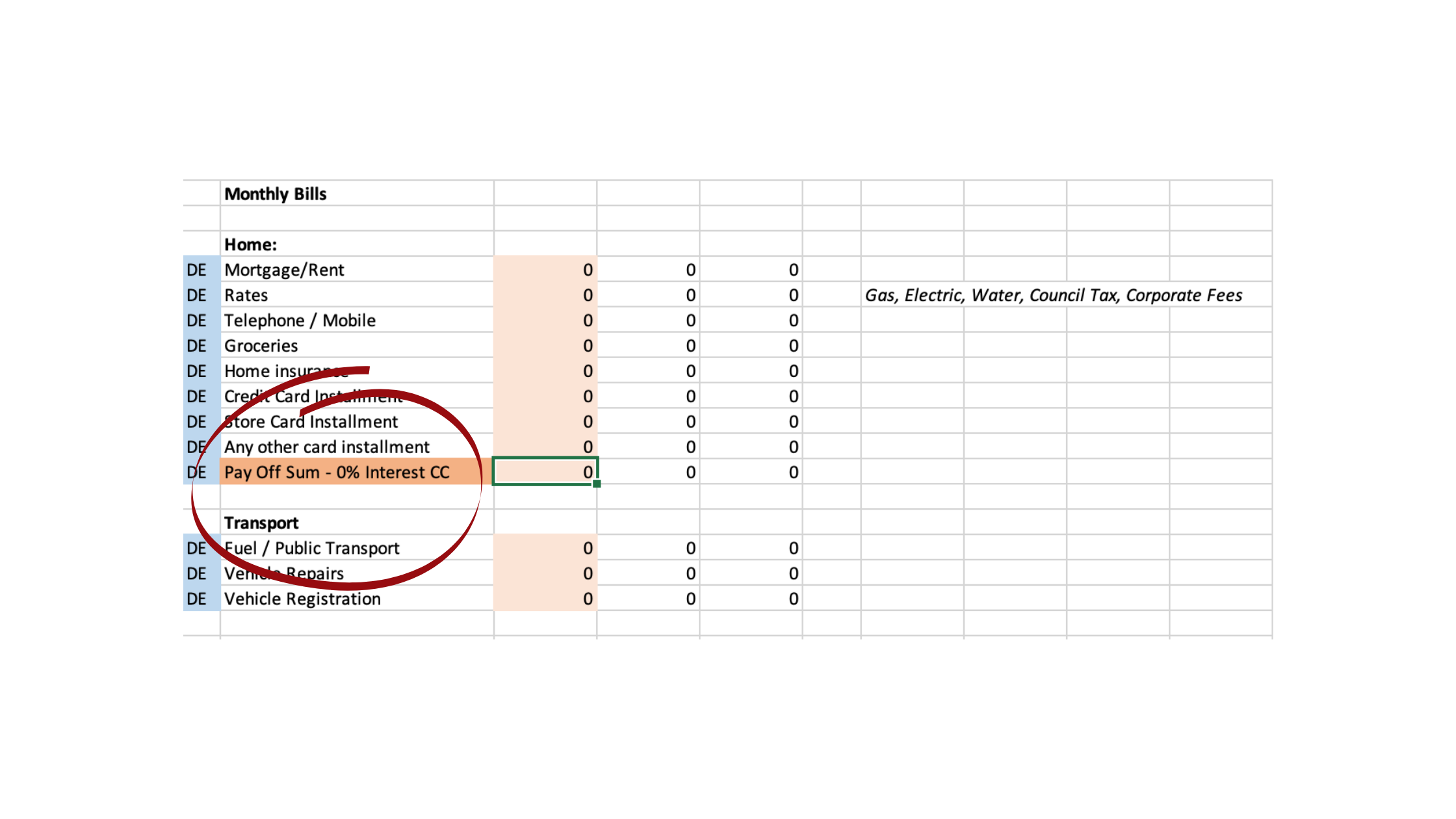

4. ADD 'PAY OFF' AMOUNT TO BUDGET.

Once you have tallied up your credit card debt on the ‘Credit Card Balances’ Page of your Budget Template, you will notice 3 lines:

-

Pay off in 12 months

-

Pay off in 18 months

-

Pay off in 24 months.

Depending on what 0% interest on balance transfer credit card you are successful in obtaining, (either 12, 18 or 24 months) the total sum provided against these three columns is what needs to be paid into your new credit card each month in order to clear the debt before interest kicks in. Add the relevant ‘Pay Off’ amount to your Personal Budget Template. The line ‘Pay Off Sum - 0% Interest CC’ has been added to the template for this purpose.

5. TWEAK YOUR BUDGET.

If the total 'Remaining Cash In Hand' (in your Personal Budget Template) is in the negative, it means you are spending more than you are making. This is where tweaks need to be made. In the business arena, we call it ‘Cut Backs’. Ask yourself this: ‘What do I need to cut out of the budget in order for me to have positive cashflow at the end of the month’? You may need to cut out a few subscriptions or reduce the clothing budget. At the end of the day, if what is coming in, is less than what is going out, you are not in control of your finances, your finances are in control of you.

6. STICK TO THE BUDGET.

There’s no point spending all this time in developing a budget that you are not going to stick to. Now is the time to exercise those resilience muscles. Stay AWAY from the shoe shop!! Avoid the Shopping Malls. Reduce the eating out, cut the spend and buckle down.

If you set your mind to this, you are more than capable of gaining back control of your finances. Once this happens, then you can start looking at ways to invest your reserves so that your money is making more money for you. That’s a whole other blog!

* My Personal Budget Template includes advice given in my recommended reading below.*

“If what is coming in, is less than what is going out, you are not in control of your finances, your finances are in control of you.”

— NALINI TRANQUIM

If you need further support in tackling your finances, why not lock in a one-2-one coaching session with me and let's nut it out.

Simply flick me an email [email protected] with a summary of your needs and we will get back to you.

Be a part of Nalini’s VIP Mailing List for exclusive goodies, news updates and personal words of encouragement to spur you on in your journey.

Don't worry, your information will not be shared.

I hate SPAM. I will never sell your information, for any reason.